Biden Administration Debating How To Overhaul A Trump

The president promised on the campaign trail to overhaul opportunity zones, which a new study suggests mostly fueled real estate investment in gentrifying areas in 2019.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

- 12

- Read in app

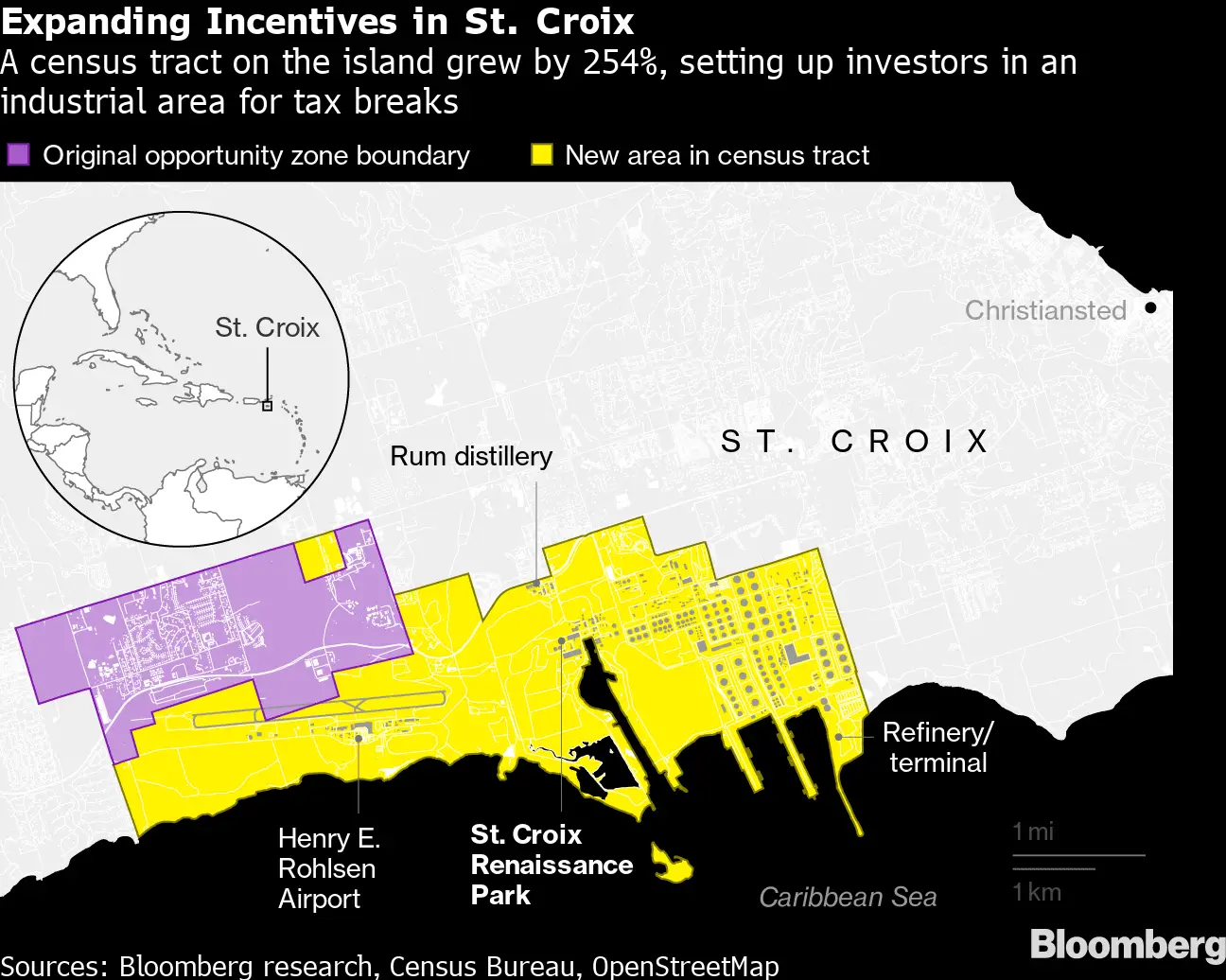

WASHINGTON The Biden administration is weighing how to overhaul a Trump-era tax incentive that was pitched as a way to drive investment to economically depressed swaths of the country but which early evidence suggests has primarily fueled real estate development in areas like Brooklyn neighborhoods that were already becoming richer and whiter.

Administration officials have not yet settled on how to make adjustments that critics and supporters alike say would improve the so-called opportunity zone program, a creation of President Donald J. Trumps 2017 tax law that Mr. Biden vowed on the campaign trail to reform.

The zones give tax breaks to certain investors who pour money into designated areas, which include high-poverty communities but also some neighborhoods that are rapidly gentrifying. Mr. Trump praised the zones repeatedly and claimed they were pulling large amounts of investment into impoverished neighborhoods, particularly Black ones.

Theyre the hottest thing youve seen, Mr. Trump said in North Carolina in February last year. Tremendous amounts of money being put into areas that hadnt seen money for decades and decades.

In The Spring Of 2018 Governor Otter Named North Nampa One Of Idahos 28 Opportunity Zones

Opportunity Zones are a new economic development tool which provides tax incentives for investors to develop in targeted areas. The tax benefits include deferring and reducing capital gains on a sliding scale based on length of time the property is held. Tax incentives are outlined on the IRS website.

Opportunity Zone Investments In Real Estate

Real estate-related Opportunity Funds have the most traction, understandably.

For investors and real estate developers, Opportunity Zones offer cheap real estate and an unlimited, untaxed upside if a neighborhood takes off.

You can invest in any type of real estate a single-family home, an apartment complex, a shopping center, or even a skyscraper office building.

Keep in mind that if you decide to go the real-estate route, you must do more than just throw cash at a piece of land or crumbling property. The government wants investors to make swift and significant improvements to an existing property to expedite the neighborhoods revitalization.

To qualify for tax perks under the program, you will need to invest the same amount into the property as your initial cost . And you will need to do so within 30 months of the purchase.

This is called the Substantial Improvement Test.

For one thing, it applies when you buy a pre-existing property or an already existing business.

For your real estate investment to qualify for the programs tax benefits, you cant just buy it and sit on it for ten years. You need to improve it.

The current Opportunity Zone legislation states that within 30 months of purchasing any built property, you need to substantially improve it using funds at least equal to 100% of the original investment.

Fortunately, you dont need to improve any land associated with the property, only physical buildings.

Read Also: What Does Trump Think About Health Care

After Rocky Start Opportunity Zones Could Boom In 2021

Sen. Tim Scott and Sean Parker tour the senator’s childhood neighborhood as an example of the areas that can see investment through the opportunity zone program.

Evan Kafka for Forbes

President-elect Joe Biden and his administration are keen to undo much of what their predecessors did. Yet when it comes to one flagging Trump initiative the opportunity zone program Biden and the Democrat-controlled Congress could actually provide a big boost.

The unique program, which offers a complicated and multipart capital gains tax breaks on funds invested into certain lower income zip codes was created by the Tax Cuts and Jobs Act of 2017 , which passed without any Democratic support. Yet the opportunity zone idea has bipartisan roots.

That crucial cross-aisle appeal, combined with the potential for increased regulatory clarity, possible tax rate increases, the massive gains of the unprecedented bull market of the last decade-plus and the economic devastation in cities from Covid-19 have all set the stage for what could be a long-anticipated rush to opportunity zones.

But from the start, the programas created and administered under Trump drew criticism for being poorly targeted, with already gentrifying neighborhoods qualifying as opportunity zones and the original legislation containing no requirements that those in the zones actually benefit from the jobs created. There wasnt even a requirement for a follow up study of the programs effectiveness.

Arctic National Wildlife Refuge Drilling

The Act contains provisions that would open 1.5 million acres in the Arctic National Wildlife Refuge to oil and gas drilling. This major push to include this provision in the tax bill came from Republican Senator Lisa Murkowski. The move is part of the long-running Arctic Refuge drilling controversy Republicans had attempted to allow drilling in ANWR almost 50 times. Opening the Arctic Refuge to drilling “unleashed a torrent of opposition from conservationists and scientists.” Democrats and environmentalist groups such as the Wilderness Society criticized the Republican effort.

You May Like: Will Trump Be Reelected In 2020 Odds

What Are Opportunity Zones

Created by changes to the tax code in the Tax Cuts and Jobs Act in December 2017, Opportunity Zones are state-nominated, economically depressed communities that are in need of new investment. These investments could, under certain circumstances, be eligable for preferential tax treatment in an effort to help spur economic development. Interested communities submitted recommendations to the Department of Treasury, and each states governor was allowed to nominate up to 25% of its low-income community tracts to receive the Opportunity Zone designation. A region will retain its Opportunity Zone status for 10 years.You can learn more from Economic Innovation Group, which led the research effort behind this new national community investment program.

Elect To Defer Your Capital Gains By Filing Form 8949

First, you need to show the government what portion of your capital gains you are planning to invest in an Opportunity Fund. If you skip this step, you will obtain no tax benefits.

First, on your next annual tax return, you report the sale of the appreciated asset itself, just like you would do even if you werent investing in Opportunity Zones.

In the case of stocks, you do this on Form 8949 , and depending on the type of the asset, on Schedule D .

And second, you need to use Form 8949 again, but this time to defer the taxation of your capital gain amount.

It means you file Form 8949 twice on the same tax return.

Recommended Reading: How To Contact Trump Organization

Opportunity Zones Structurally Favor High Returns Not Community Benefits

Opportunity zones have fewer limits on the range of qualifying investments and fewer safeguards to prevent abuse and revenue loss than other tax-based programs designed to promote community and economic development, such as the New Markets Tax Credit and the Low-Income Housing Tax Credit programs. Whats more, regulations issued by the Trump administration broadened the intent of the original law and created opportunities for abuse. As a result of lenient regulations, for example, investors can claim a full tax break even if only 63 percent of the capital in an opportunity fund is actually invested in an opportunity zone. Moreover, the original law includes no requirements that opportunity zone residents actually benefit from investments.

Opportunity zones singular focus on reducing taxes owed on capital gains structurally favors projects that generate high returns, rather than the greatest social impact.

New Report Shows Opportunity Zones On Track To Lift One Million Americans Out Of Povertypoverty Rate To Be Reduced By 11% In Opportunity Zones Through Billions In Investment And New Job Opportunities

WASHINGTON – The White House Council of Economic Advisers yesterday delivered a Progress Report on President Trumps Opportunity Zones initiative to White House Opportunity and Revitalization Council Chairman Ben Carson, Secretary of the U.S. Department of Housing and Urban Development. The CEA estimates that Opportunity Zones have already generated approximately half a million jobs, attracted $75 billion in capital investments, and are on track to reduce the poverty rate in Opportunity Zones by 11 percent-lifting 1,000,000 people out of poverty

This tremendous progress report shows the American people, especially the families who have felt forgotten for years, President Trumps Great American Comeback is in fact underway, said Secretary Ben Carson. Opportunity Zones have created half a million jobs, generated billions in economic investment, and reduced our countrys poverty rate-and is just the beginning. President Trumps bold leadership is providing families with new opportunities to break the cycle of poverty and local leaders with a tool to assist them in breathing new life into communities that have been forgotten for far too long.

To compile the Progress Report, the Council of Economic Advisers examined Opportunity Zone investments and activities through the end of 2019. CEA found the tax cuts have spurred a large investment response. Highlights of the report include:

Don’t Miss: Who Is Older Biden Or Trump

How Rich Investors Exploit Trump

Clip: 11/11/2021 | 9m 16s | Video has closed captioning.

Former President Donald Trump’s 2017 tax plan created Opportunity Zones a program of tax incentives to encourage investment in low-income communities. But as Paul Solman reports, that program has not necessarily spurred economic growth and jobs in distressed communities the way it had been envisioned.

Aired: 11/11/21

- Embed Code for this video

- Copy a link to this video to your clipboard

Automatic Spending Cuts Averted/paygo

Under the Statutory Pay-as-You-Go Act of 2010 , laws that increase the federal deficit will trigger automatic spending cuts unless Congress votes to waive them. Because the Act adds $1.5 trillion to the deficit, automatic cuts of $150 billion per year over ten years would have applied, including a $25 billion annual cut to Medicare. Because the PAYGO waiver is not allowed in a reconciliation bill, it requires separate legislation which requires 60 votes in the Senate to end a filibuster. If Congress had not passed the waiver, it would have been the first time that statutory PAYGO sequestration would have occurred. However, the PAYGO waiver was included in the continuing resolution passed by Congress on December 22 and signed by President Trump.

Recommended Reading: How Do I Send A Text Message To President Trump

Important Links For Opportunity Zone Investment And Community Resilience And Revitalizationexecutive Order On Establishing The White House Opportunity And Revitalization Council

2019 Legislative Conference: Making Sense of New Federal Funding Tools: Opportunity Zones and Pay for Success Community Development Archives from the National Housing & Rehabilitation AssociationThe White House Opportunity and Revitalization Council –Implementation Plan for the White House Opportunity and Revitalization CouncilThe Education Opportunity in Opportunity Zones

Changing Incomes In New Orleans

Early opportunity zone development is often happening in neighborhoods where income was already rising, not in struggling areas.

1 MILE

Those investors include Mr. Scaramucci, who briefly served as White House communications director in 2017 and has claimed credit for helping to create the opportunity-zone plan. We got to get into this business because this will be transformative to the United States, he said recently.

Mr. Scaramuccis investment firm, SkyBridge Capital, has raised more than $50 million in capital gains from outside investors, and most of it is being used to finance the hotel, according to Brett S. Messing, the companys president. He said the hotel was likely to be the first of numerous opportunity-zone projects financed by SkyBridge.

Less than two miles away is the poorest opportunity zone in Louisiana and one of the poorest nationwide. The zone includes the Hoffman Triangle neighborhood, where the average household earns less than $15,000 per year. Block after block, streets are lined with dilapidated, narrow homes, many of them boarded up. On a recent afternoon, one of them was serving as a work site for prostitutes.

City officials, including the head of economic development for New Orleans, said they were not aware of any opportunity-zone projects in this neighborhood.

Terrance Ross, a construction worker who has lived in the area for 20 years, is familiar with the building boom underway in the Warehouse District.

You May Like: How To Donate To Trump Campaign

New Research Adds To Evidence That Opportunity Zone Tax Breaks Are Costly And Ineffective

Policymakers should enact commonsense reforms to opportunity zones to boost transparency and accountability, stem rising costs, and focus attention on communities most in need.

Important new research by economists Patrick Kennedy and Harrison Wheeler adds to a growing volume of evidence that opportunity zone tax breaks, created as part of the 2017 Tax Cuts and Jobs Act , are costly and poorly targeted and do little to create jobs or improve conditions in poor communities. Instead, opportunity zones provide massive tax benefits to wealthy investors while subsidizing investment in few communities with relatively higher incomes, home values, and educational attainment as well as stronger income and population growth.

A growing body of evidence bolsters the case for commonsense reforms that would improve the transparency and accountability of zone incentives, such as instituting reporting requirements and requiring assets used to qualify for tax breaks to be used exclusively within a zone. Absent future evidence to the contrary, opportunity zone incentives should not be extended beyond their scheduled 2026 expiration.

The 3 types of opportunity zone tax breaks

Opportunity zones provide three different tax breaks for investors that roll over gains earned outside a zone into special funds called qualified opportunity funds:

What Can An Opportunity Zone Fund Invest In

While the rules for Opportunity Zones are simple, you cant just go out and buy a property or a business in one of the designated zones if you want to qualify for the tax breaks.

Instead, you must use a special investment vehicle an Opportunity Zone Fund .

There are dozens and dozens of such funds, which you can research here and here.

If you invest in one of them, then the rules are pretty easy. The funds administrators will advise you about how to stay compliant.

But if you know what you are doing and prefer to be in full control of your investments, then you can form your own fund and invest that way.

You can also consider starting your fund if you picked a zone youd love to invest in, but no public funds exist there yet.

Your Opportunity Fund can invest in real estate, new or existing business, or business assets located in a designated Opportunity Zone.

Read Also: When Is Trump’s Next Campaign Rally

Number Of Opportunity Zones By Median Household Income

More than 7 percent of opportunity zones had household incomes above the median census tract in 2017. Investors are focusing on projects in these neighborhoods.

$54,408

And nearly 200 of the 8,800 federally designated opportunity zones are adjacent to poor areas but are not themselves considered low income.

Under the law, up to 5 percent of the zones did not need to be poor. The idea was to enable governors to draw opportunity zones in ways that would include projects or businesses just outside poor census tracts, potentially creating jobs for low-income people. In addition, states could designate whole sections of cities or rural areas that would be targeted for investment, including some higher-income census tracts.

In some cases, developers have lobbied state officials to include specific plots of land inside opportunity zones.

In Miami, for example, Mr. LeFrak who donated nearly $500,000 to Mr. Trumps campaign and inauguration and is personally close to the president is working with a Florida partner on a 183-acre project that is set to include 12 residential towers and eight football fields worth of retail and commercial space.

In spring 2018, as they planned the so-called Sole Mia project, Mr. LeFraks executives encouraged city officials in North Miami to nominate the area around the site as an opportunity zone, according to Larry M. Spring, the city manager. They did so, and the Treasury Department made the designation official.

How To Calculate Your Personal Tax Savings

We have created a free Excel Opportunity Zones Calculatorthat shows you the potential tax savings for your PERSONAL situation.

This excel sheet allows you to enter details about your personal situation, current gains and prospective investments to see a performance comparison.

The calculator will show you

- How much you will save on capital gains taxes on your original asset if you sell it and invest the proceeds in an Opportunity Zone

- How much less in tax you will pay if you invest in Opportunity Zones when compared to traditional investment.

- NET after-tax side-by-side comparison for investment results for Opportunity Zone vs traditional investment.

This sheet could save you hours trying to figure out if an investment in opportunity zones is right for you.

Also Check: Why Should I Vote For Donald Trump

‘the Icing Is Very Thin’

In Louisville, Kentucky, where racial tensions increased following the fatal police shooting of Breonna Taylor, there was optimism when the Opportunity Zone program was first launched, says Seiffert.

“You can talk to some of the bigger metro areas where there are pockets of money and influence and there are some big deals being done and they are great,” said Seiffert. “For the rank and file and a city like Louisville it has done very little and for the state it’s very little. I spent a lot of time on it and I have not seen it materialize yet.”

Even supporters acknowledge that Opportunity Zone are an added incentive. They say they don’t lure investors to brand new projects, but are “icing on the cake” for major real estate deals. Seiffert agrees with that description, but adds, “The icing is very thin if you ask me.”

Gil Holland, a Louisville-based businessman who is one of the developers behind a downtown neighborhood called NuLu that is in an Opportunity Zone, says the program has enhanced investment deals for investors who were already going to make an investment rather than lured investors to poor neighborhoods. “They will choose NuLu instead of a neighborhood like that really needs it.”

Demetrius Gray, a Black tech entrepreneur whose Louisville business Weathercheck is located in an Opportunity Zone, said he was delighted to receive $250,000 from an Opportunity Zone fund. He says the investment stabilized his company. “It created more runway for us,” he told NBC News.